New £18 billion PPI scandal is ‘an absolute mega rip-off’, says Nigel Farage

New £18 billion PPI scandal is a ‘an absolute mega rip-off’, says Nigel Farage

|GBN

Lawyer Damon Parker said the amount still to be claimed is equal to £3,000 for adult in the UK

Don't Miss

Most Read

Latest

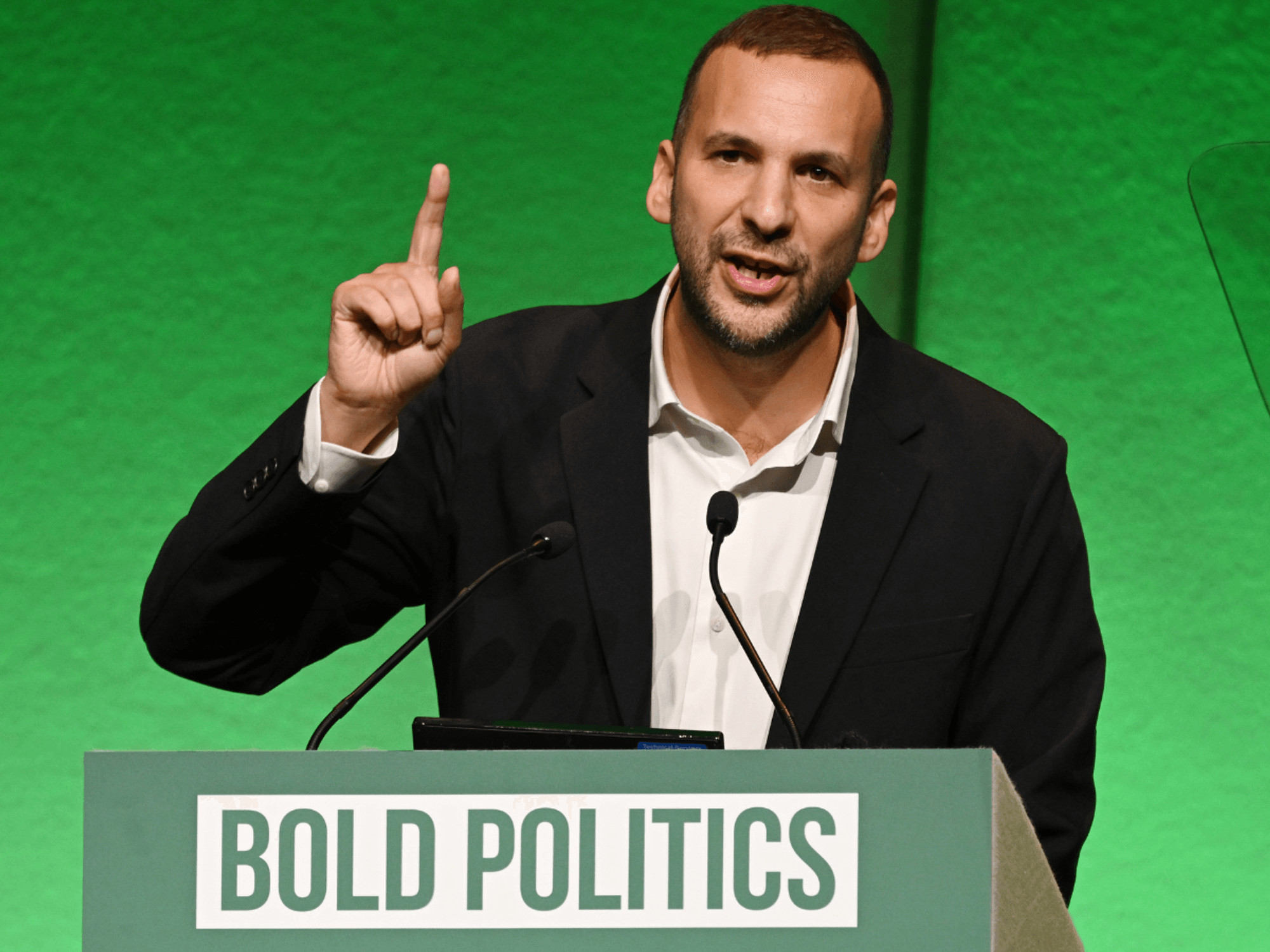

A new £18 billion PPI mis-selling scandal has been described as “an absolute mega rip-off” by Nigel Farage.

He hit out as Damon Parker, a senior partner with law firm Harcus Parker, revealed he is organising a class action lawsuit in an attempt to recover the billions that is still due to consumers.

Those affected, he said, could be due at least £3,000 each.

Mr Parker told GB News: “PPI was theoretically a kind of insurance that would protect you from not being able to repay your loans.

WATCH NOW:

"But the problem with it was first of all, it was bad insurance.

“It frequently didn't cover what it was supposed to cover.

"If you were self-employed, for example, it didn't cover you obviously, and often people were covered for that risk anyway.

“But the big issue, the one that hasn't I think been adequately publicised, is the fact that for every pound you paid in PPI premium, between 75% and 90%, 95% sometimes, was a commission paid to the bank.”

Mr Farage responded: “This is an absolute mega rip-off. And this was never declared?”

Nigel Farage | PA

Nigel Farage | PAMr Parker said: “It was never declared, it was a secret commission.

"It's been found by the Supreme Court in PPI cases to be against the provisions of the Consumer Credit Act, it's unfair.

“Frequently people don't know and this is the essence of the secret commission claims, you don't know that you pay the secret commission but often you don't even know that you have PPI, it might have been in the statement, but you had to be looking carefully to see it.“

PPI started to be sold in probably in the 1980s, 64 million policies. So overall, and although we think probably about £50 billion pounds has been returned to customers including the expenses of the banks, £18 billion is still in the banking system to be returned to customers.”

Mr Parker said most people are under the false impression that they can no longer make PPI claims and he is organising a class-action legal case involving 50,000 people who want their money back

5 pounds banknotes with Queen Elizabeth II are displayed on a table

|GETTY

He said most people will not be aware that they had PPI but the firm has set up a website - ppiglo.com - where people can register to join the action.

“Sign up, we'll check for you. And 350,000 people also have already asked us to check and we have 50,000 clients ready to go on these cases,” Mr Parker said.

“It depends very much on how they use their credit card, what kind of PPI it was, but if you do an averaging out of £18 billion and 6 million people, we think it amounts to about £3,000 pounds per person.”

He added: “One of the stories is that PPI stopped, it didn't stop but it was supposed to stop in 2019. Remember those Arnold Schwarzenegger adverts…that was to encourage people to come forward to claim to the FCA scheme.

“But that was a peculiar scheme because it didn't really give people back everything that they'd lost or been charged.”